Opening entries include revenue, expense, Depreciation etc., while closing entries include closing balance of revenue, liability, Depreciation etc. After the closing journal entry, the balance on the dividend account is zero, and the retained earnings account has been reduced by 200. Permanent accounts, also known as real accounts, do not require closing entries. Examples are cash, accounts receivable, accounts payable, and retained earnings. These accounts carry their ending balances into the next accounting period and are not reset to zero.

Temporary accounts:

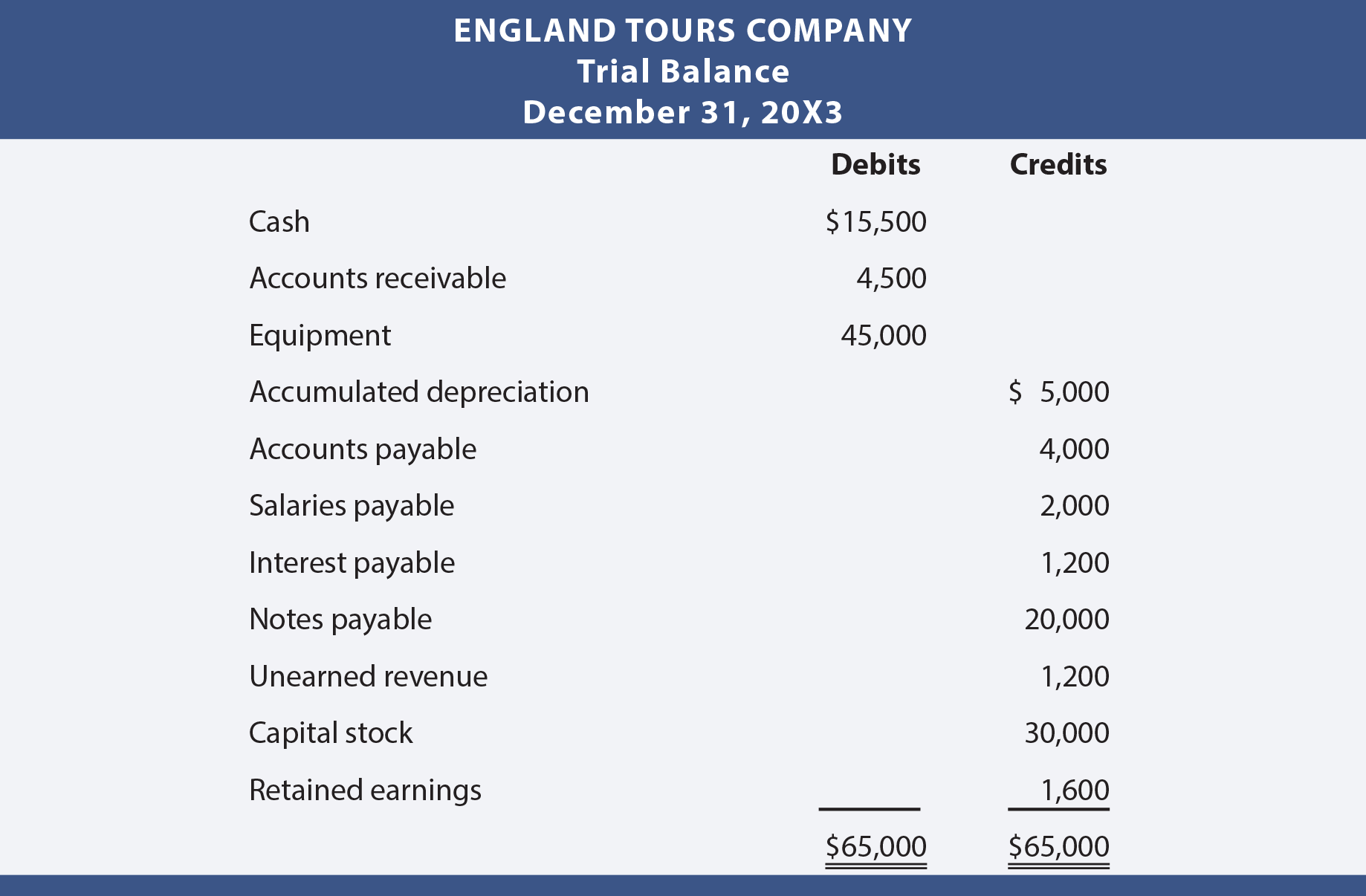

All expenses can be closed out by crediting the expense accounts and debiting the income summary. Both closing and opening entries record transactions, but there is a slight variation in their purpose. Suppose a business had the following trial balance before any closing journal entries at the end of an accounting period. Once all the adjusting entries are made the temporary accounts reflect the correct entries for revenue, expenses, and dividends for the accounting year.

What is the Income Summary Account in Closing Entries?

Notice that the balance of the Income Summary account is actually the net income for the period. Remember that net income is equal to all income minus all expenses. The account is then cleared out and transferred to retained earnings, which we will explain. Accounts can be closed on a monthly, quarterly, semi-annual or annual basis. It is really determined by a company’s need for financial reporting.

Get Started

All temporary accounts must be reset to zero at the end of the accounting period. To do this, their balances are emptied into the income summary account. The income summary account then transfers the net balance of all the temporary accounts to retained earnings, which is a permanent account on the balance sheet. These permanent accounts form the foundation of your business’s balance sheet.

FAQs on Closing Entries

We at Deskera offer the best accounting software for small businesses today. Our program is specifically developed for you to easily set up your closing process and initiate book closing within seconds – no prior technical knowledge necessary. Now, the income summary account has a zero balance, whereas net income for the year ended appears as an increase (or credit) of $14,750. Now that we know the basics of closing entries, in theory, let’s go over the step-by-step process of the entire closing procedure through a practical business example. And so, the amounts in one accounting period should be closed so that they won’t get mixed with those in the next period. For partnerships, each partners’ capital account will be credited based on the agreement of the partnership (for example, 50% to Partner A, 30% to B, and 20% to C).

Made at the end of an accounting period, it transfers balances from a set of temporary accounts to a permanent account. Essentially resetting the account basic accounting principles and concepts for t balances to zero on the general ledger. First, all the various revenue account balances are transferred to the temporary income summary account.

- The last step of an accounting cycle is to prepare post-closing trial balance.

- Clear the balance of the revenue account by debiting revenue and crediting income summary.

- At the end of the accounting period, the balance is transferred to the retained earnings account, and the account is closed with a zero balance.

- In a partnership, a drawing account is maintained for each partner.

- Made at the end of an accounting period, it transfers balances from a set of temporary accounts to a permanent account.

To close revenue accounts, you first transfer their balances to the income summary account. Start by debiting each revenue account for its total balance, effectively reducing the balance to zero. Then, credit the income summary account with the total revenue amount from all revenue accounts. Total revenue of a firm at the end of an accounting period is transferred to the income summary account to ensure that the revenue account begins with zero balance in the following accounting period. The next step is to repeat the same process for your business’s expenses.

Now that the journal entries are prepared and posted, you are almost ready to start next year. Remember, modern computerized accounting systems go through this process in preparing financial statements, but the system does not actually create or post journal entries. A net loss would decrease owner’s capital, so we would do the opposite in this journal entry by debiting the capital account and crediting Income Summary.

Income and expenses are closed to a temporary clearing account, usually Income Summary. Afterwards, withdrawal or dividend accounts are also closed to the capital account. To close the drawing account to the capital account, we credit the drawing account and debit the capital account.